are funeral expenses tax deductible in canada

The following expenses can be claimed. It is taxable upon death benefit.

Can You Write Off Funeral Expenses On Taxes In Canada Ictsd Org

The funeral homes viewing and visitation fees.

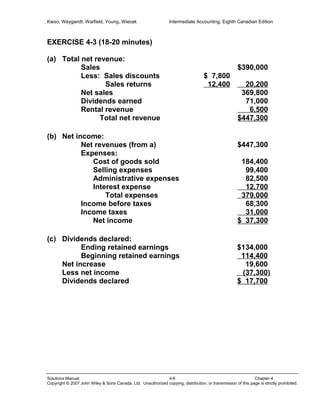

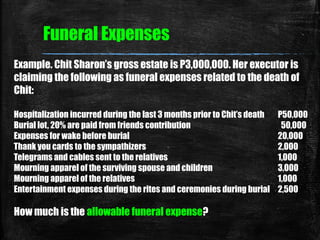

. Deductible medical expenses may include but are not limited to the following. In short these expenses are not eligible to be claimed on a 1040 tax form. Funeral and burial expenses are only tax deductible if theyre paid for by the estate of the deceased person.

The Canada Pension Plan pays a flat 2500 death benefit to the estate. No never can funeral expenses be claimed on taxes as a deduction. This means that you cannot deduct the cost of a funeral from your individual tax returns.

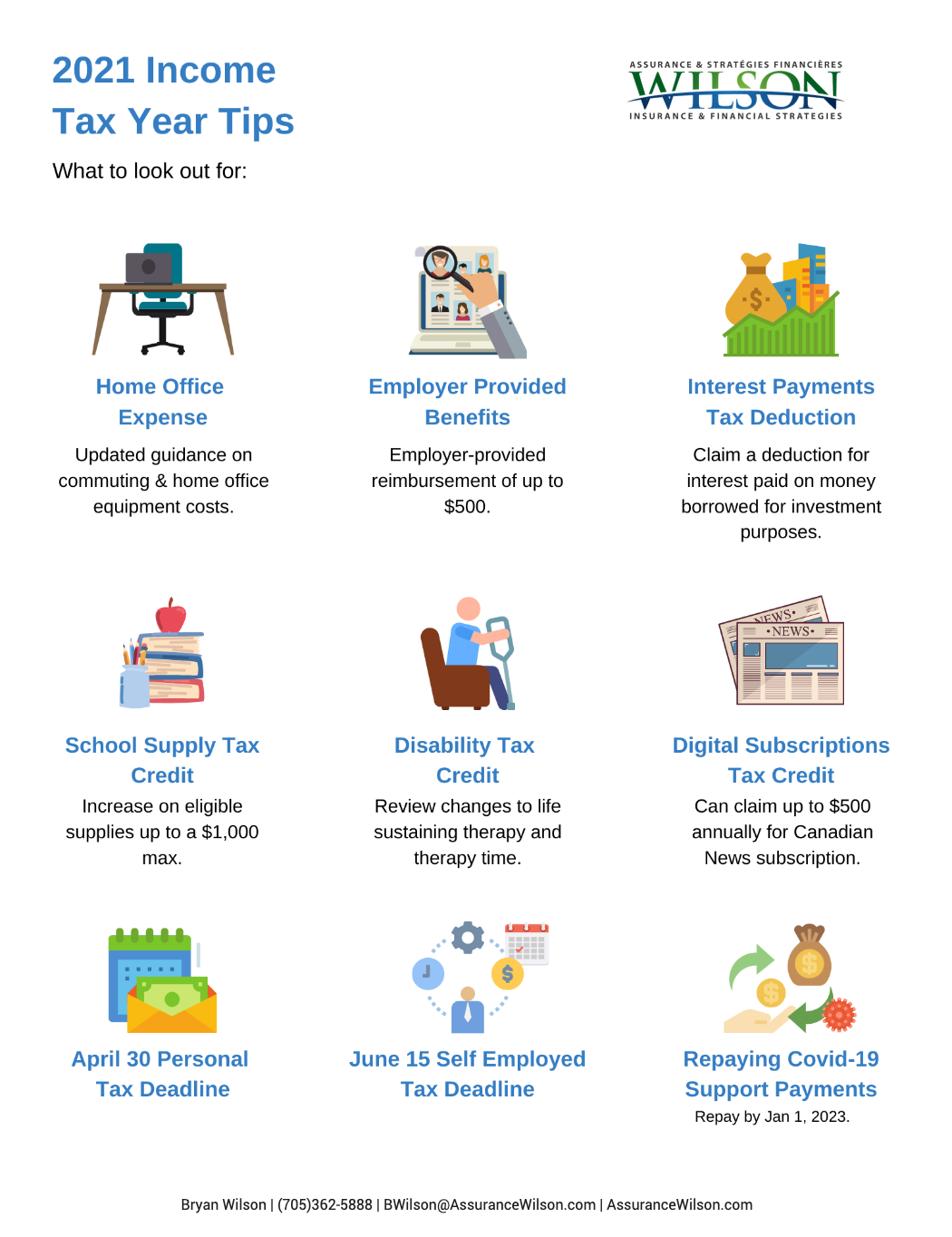

Who cannot deduct funeral expenses. There is no tax deduction for either of these expenses. The Canada Revenue Agency CRA has designated that funds held in a prepaid funeral account called an Eligible Funeral Arrangement EFA must be guaranteed to 10000000 and earns tax exempt interest.

Legal fees you paid to get a separation or divorce or to establish custody for a child funeral expenses wedding expenses loans to family members that presumably went bad and a. The cost of the cremation urn and niche. While individuals cannot deduct funeral expenses eligible estates may be able to claim a deduction if the.

This cost is only tax-deductible when paid for by an estate. Deducting funeral expenses as part of an estate. As with real estate automobiles food and pretty much everything else how much you pay for goods and services varies according to where you are.

Newlyweds Brooklyn Beckham and Nicola Peltz join David and Victoria in matching convertibles. Are funeral expenses tax deductible in Canada. An EFA must have one or more custodians each of whom was resident in Canada when the arrangement was.

Qualified medical expenses include. That means the estate has to reimburse any individual who helped cover the cost of funeral expenses before it can deduct those funds. Funeral costs in Canada can be as low as 1000 or as high as 20000 with the average around 9150.

Body transportation and embalming fees. The cost of a funeral or cremation is influenced by where it takes place. What Funeral Expenses Are Tax Deductible In Canada.

Funeral expenses are not tax deductible because they are not qualified medical expenses. In other words funeral expenses are tax deductible if they are covered by an estate. This means that you cannot deduct the cost of a funeral from your individual tax returns.

These are considered to be personal expenses of the family members and attendees and funeral expenses are not deductible on personal income tax returns. This link will open a new tab. Have a question about funeral costs.

Sorry but funeral expenses are not an eligible deduction and cannot be claimed on any tax returns. These are personal expenses and cannot be deducted. The cost of the casket.

Yes the estate can deduct funeral expenses that it has paid for. The fees for the memorial service whether religious or not. Ukraines Draft Dodgers.

The passing of a family member can prove difficult and the added stress of managing monetary concerns makes for a truly unpleasant time. In other words if you die and your heirs pay for the funeral themselves they will not be able to claim any deductions for those expenses on their taxes. Are Funeral Expenses Tax Deductible In Canada.

An eligible funeral arrangement EFA is an arrangement established and maintained by a qualifying person eg a funeral director or cemetery operator for the sole purpose of funding funeral or cemetery services for one or more individuals. Funeral expenses are never deductible for income tax purposes whether theyre paid by an individual or the estate which might also have to file an income tax return. CANADA EXPRESS NEWS Our News Always Makes the Headline Trending Now.

Unfortunately funeral expenses are not tax-deductible for individual taxpayers. They are never deductible if they are paid by an individual taxpayer. Are funeral expenses tax deductible.

Qualified medical expenses must be used to prevent or treat a medical illness or condition. While the IRS allows deductions for medical expenses funeral costs are not included. The CRA specifically cited the following examples of expenses that are non-deductible but tend to be claimed erroneously as other or additional deductions on these lines.

The CPP Death Benefit is a payment made that is supposed to help with funeral expenses for a deceased CPP contributor. The answer to this is quite blunt. The IRS deducts qualified medical expenses.

Are funeral expenses tax deductibleWhen a loved one passes away most families hold a funeral to mourn remember the life of the deceased and pay their. Can I deduct funeral expenses probate fees or fees to administer the estate. Individual taxpayers cannot deduct funeral expenses on their tax return.

Provided the deceased gave entitlement to that benefit. Rules for Claiming Funeral Expense Tax Deductions. Upon the death of an estate member the Canada Pension Plan provides a flat 2500 death benefit.

To claim medical. The answer unfortunately is no and heres why. The primary rule for claiming funeral expenses as a tax deduction is that the costs must be paid out of a decedents estate.

Funeral expenses that are NOT tax-deductible are any which are not paid by the deceased persons estate. You can read more about this issue here. Expenses for funerals probate charges and fees are all payable by the estate.

These are personal expenses and cannot be deducted. Death benefit is taxable. On the federal website Canadaca it says.

The 1040 tax form is the individual income tax form and funeral costs do not qualify as an individual deduction. Thats taxable in the hands of the ultimate. The finances associated with funerals can prove exorbitant and if you are not prepared to cover the costs it can prove devastating.

Can I deduct funeral expenses probate fees or fees to administer the estateNo.

Can Funeral Expenses Be Claimed On Taxes In Canada Ictsd Org

Are Prepaid Funeral Expenses Tax Deductible In Canada Ictsd Org

Funeral Costs Questions And Answers

Is Funeral Expenses Tax Deductible In Canada Ictsd Org

What Is Final Expense Insurance Don T Be A Zombie Find Out Now

Are Funeral Costs Tax Deductible In Canada Ictsd Org

Estate Tax Pdf Estate Tax In The United States Tax Deduction

Blog Wilson Insurance And Financial

How Much Does A Funeral Cost In Canada Breaking Down All Costs

Tax Deductions For Funeral Expenses Turbotax Tax Tips Videos

What Is Final Expense Insurance Don T Be A Zombie Find Out Now

03 Chapter 4 Deductions From Gross Estate Part 01

Are Funeral Expenses A Tax Deduction In Canada Ictsd Org

Canada Revenue Agency Tax Tip Eight Things To Remember At Tax Time Lifestyles Thesuburban Com

How To Apply For The Canada Pension Plan Cpp Death Benefit Loans Canada

03 Chapter 4 Deductions From Gross Estate Part 01